Configure comprehensive borrower journeys to build lasting relationships and create new value for borrowers and your business.

Homeowner360 makes it easy to engage borrowers and create opportunities to add value for you and your customers.

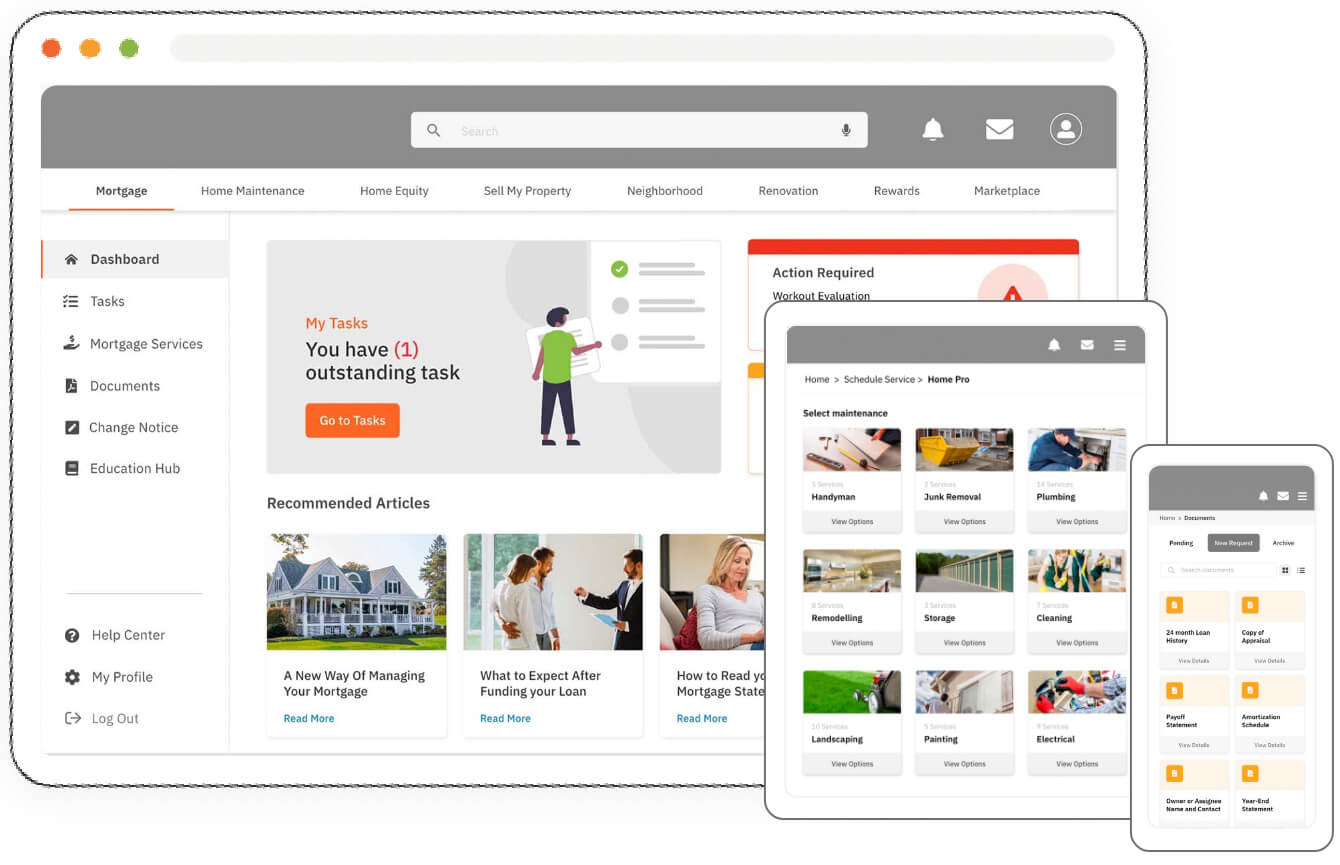

Empower homeowners with a configurable, digital self-service platform that improves customer interactions through a centralized, mobile interface. Homeowner360 eliminates the common communication challenges that frustrate mortgage customers, resulting in better interactions, higher net promoter scores, and increased customer satisfaction.